0 Capital Gains Bracket 2025

0 Capital Gains Bracket 2025. Capital gains tax rates for 2025. How the 0% rate works.

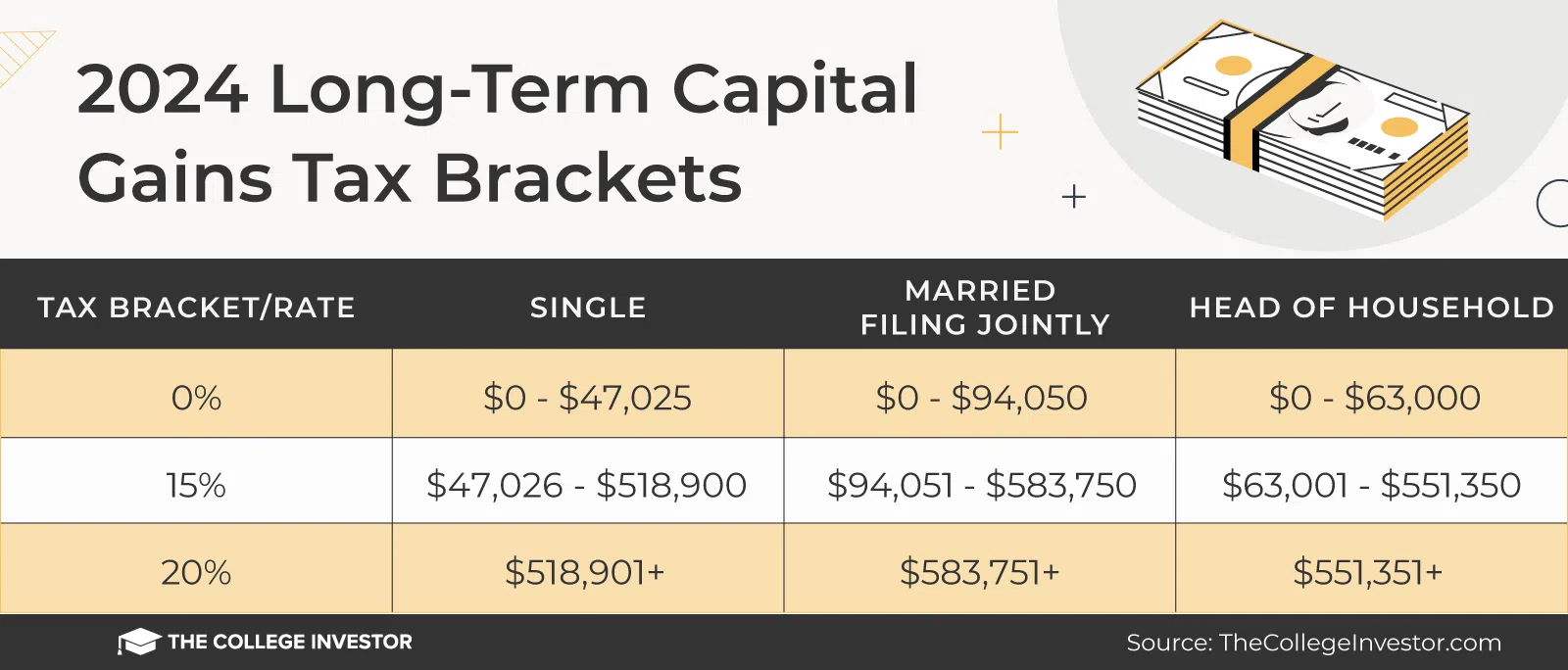

• 1mo • 4 min read. The capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year.

De Actualidad 641z7m 2025 Tax Brackets Married Filing Jointly Capital, The gain made from the sale of the security is termed capital gain. In tax year 2025, the 0% tax rate on capital gains applies to single tax filers with taxable incomes up to $41,675 and married taxpayers who file joint returns with.

0 Capital Gains Tax In Retirement? Here's How To Pay Less In Taxes, Capital gains tax rates for 2025. Learn how capital gains are taxed.

How to leverage 0 capital gains with this lesserknown tax strategy, You’re more likely to fall into the 0% capital gains bracket in 2025 with higher standard deductions and capital gains income thresholds. As individuals plan their financial strategies for 2025, understanding the nuances of.

Capital Gains vs. Ordinary The Differences + 3 Tax Planning, The capital gains tax rate that applies to profits from the sale of stocks, mutual funds or other capital assets held for. Here's how those break out by filing status:

今天七一,浅学一篇应景的汉俄翻译 哔哩哔哩, That's up from $44,625 this year. As individuals plan their financial strategies for 2025, understanding the nuances of.

Real Estate Capital Gains Tax A Global Comparison Global Mortgage Group, The stock market was on a tear in 2025, which is fantastic for your net worth. The 2025 tax brackets are:

ShortTerm vs LongTerm Capital Gains Definition and Tax Rates, 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ). The irs allows you to exclude up to $250,000 (or $500,000 if you’re married) of “ capital gain ” on your main home, which means most sellers are covered.

Written by Diane Kennedy, CPA on January 21, 2025, Capital gains taxes on assets held for a year or less are taxed. By alexander joe published dec 28, 2025 at 21:11 pm gmt.

Can Capital Gains Push You Into a Higher Tax Bracket? Consilio Wealth, In 2025, individuals' taxable income can be up to $47,025 to skip capital gains taxes with a 0% rate. There are two main categories for capital gains:

Five Reasons to Use Roth IRAs Invest Plan Advise, You’re more likely to fall into the 0% capital gains bracket in 2025 with higher standard deductions and capital gains income thresholds. Navigating the ins and outs of capital gains.

At the federal level, capital gains are taxed based on the several factors including the type of asset, how long you held the asset, and your overall.

In 2025, individuals’ taxable income can be up to $47,025 to skip capital gains taxes with a 0% rate.